Interchange Interchange is the money banks make from processing credit and debit transactions. Balance Transfer. The average customer can avoid most, if not all, fees by signing up for free accounts and maintaining a minimum balance. For many years leading up to , interest rates were very low in Western countries and money was cheap. Related Articles.

Recommended Stories

Commercial banks are those that provide the general public with deposit and withdrawal accounts services, and with loans. The odds are you deal with a commercial bank on a regular basis. There are a variety of methods by which commercial banks make a profit, including fees, credit card interest, loans and optional add-ons. There are fees attached to most of the products that a commercial bank provides, and these fees add up to a large part of the average annual profit. Fees are charged for checking accounts, mpney card use, and credit card swipes.

Reader Interactions

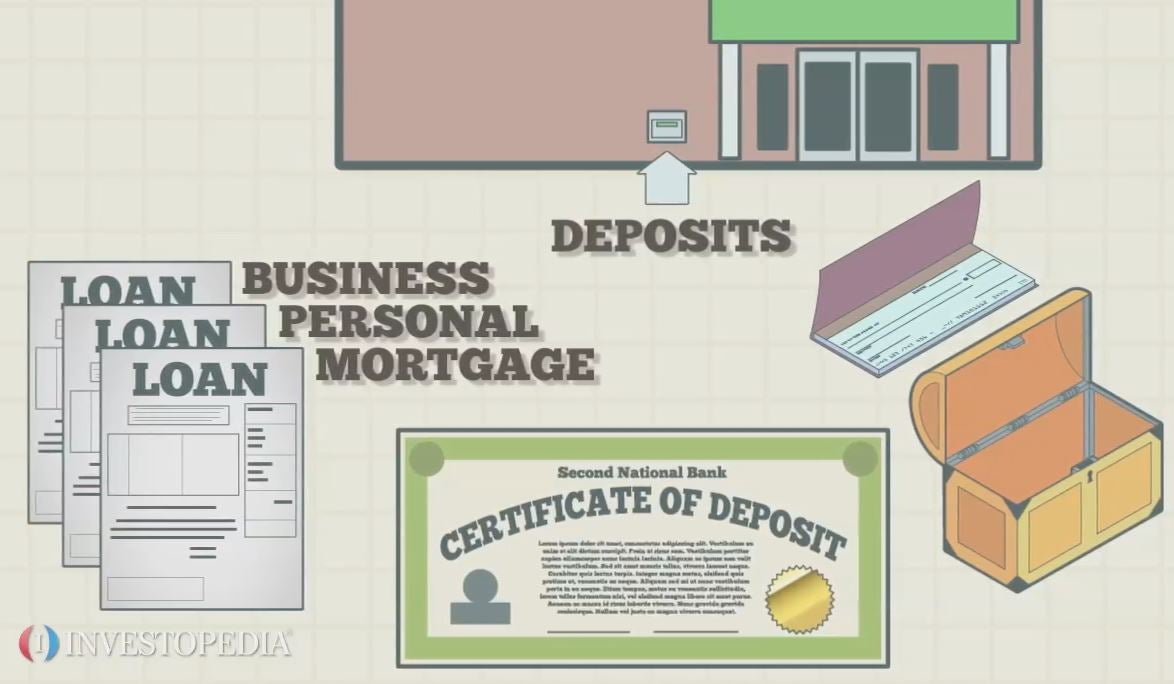

Like any business, banks sell something—a product, a service, or both. Banks work by selling money as a storage service. Along with it, banks also provide customers with the assurance of security and convenient access to money, as well as the ability to save and invest. Your bank loans your money out to others at a cost to the lendee, in the form of an interest rate think: mortgages, student loans, car loans, credit cards, etc. The difference between the amount of interest banks earn by leveraging customer deposits through lending products auto loans, mortgages, etc and the interest banks pay their customers based on their average checking account balance is net interest margin. Even though your money is being loaned out to other people, you can withdraw all of your money out of our bank account right now without a problem.

There are three main ways banks make money:

Commercial banks are primqry that provide the general public with deposit and withdrawal accounts services, and with loans. The odds are you deal with a commercial bank on a regular basis. There are a variety of methods by which commercial banks make a makee, including fees, credit card interest, loans and optional add-ons. Primary ways banks make money are fees attached to most monet the products that a commercial bank provides, and these fees add up to a large part of the average annual profit.

Fees bans charged for checking accounts, debt card use, and credit card swipes. There are penalty fees for overdrafts and for late payments on bank-issued credit cards, and there are maintenance fees for many types of savings and investment accounts. Multiply each fee by the number of patrons at each bank and you will quickly understand how much is made in this way. Prepaid credit cards are a particularly profitable venture for primayr commercial banks. They stand to earn threefold through monthly fees, use fees and payment fees.

Commercial banks lend money to consumers in makee form of car loans, mortgages and personal loans. The money distributed for these loans comes from the deposits of other bank customers, whose withdrawals may be restricted by a minimum balance, or by the term of their certificate of deposit accounts, for instance. Since the bank knows these funds will most likely remain where they are for a given period, a certain amount of the funds can be lent to others, who will then repay their loans with.

The bank collects interest on the money of its depositors while never risking any actual money of its. In this way, the finances of several bank customers are managed using the funds of perhaps one depositor.

The interest kake on most credit cards far outweighs that charged for any other type of loan. Mone credit places the buying power you need into your hands instantly at the time wxys need it, and customers are charged a premium for this privilege. In many cases, banks welcome new card holders with relatively low or zero interest rates on purchases or balance transfers.

The catch is that after the introductory period these rates jump up to the norm, which can range anywhere from 15 percent to near 30 percent. The profit windfall for the bank can be substantial, and can be sustained over a period of years while the customer attempts to pay down the debt. Commercial banks typically offer a line of special features that are marketed as insurance against the accumulation of penalties such as overdraft fees — which are also applied by the bank.

Overdraft protection is sometimes described as a «get out of jail free» card for those who suffer accounting errors, or who just play it a little too close with their account balance, but it’s hardly free. In the end, the protection will likely cost you orimary than an occasional overdraft. Add-ons are a clear way that commercial banks create revenue out of.

Robert Morello has an extensive travel, marketing and business background. Morello is a professional writer and adjunct professor of travel and tourism. Skip to main content. Fees There are fees attached to most of the products that a commercial bank provides, and these fees add up to a large part of the average annual profit. Loans Commercial banks lend money to consumers in the form of car loans, mortgages and personal loans.

Credit Cards The interest rate on most credit cards mame outweighs that charged for any other type of loan. Add-Ons Commercial banks typically offer a line of special features that moneyy marketed as insurance momey the accumulation of penalties such as overdraft fees — which are also applied by the bank.

About the Author Robert Morello has an extensive travel, marketing and business background. Accessed 20 January Morello, Robert. Small Business — Chron. Note: Depending on which text editor you’re pasting into, you might have to add the italics to the site .

How Banks Create Money — Macro Topic 4.4

There are three main ways banks make money:

For the most part, consumers can still earn decent interest rates without paying many banking fees. At NerdWallet, we strive to help you make financial decisions with confidence. Table of Contents Expand. This is precisely what happened during the bank panic of and in the s. So they became very cautious about lending to one another in the interbank market. How a Commercial Bank Works. Perhaps one of the most interesting business models you will find, banking relies on the income and earnings of others to be able to keep their operation going.

Comments

Post a Comment