Purchasing IPO stock depends on when in the process you buy it. Big U. There are two parts to the long-term buy-and-hold strategy that need to function properly to make an investment work. Invest Now. Let’s look back at its go-public financials and find out how much Mastercard’s IPO investors have benefited by holding its stock. This is called a lock-up period , and is meant to prevent employees from all dumping their stock and depressing the stock price. Before the champagne pops, you’ll want to make sure you’re setting yourself up for the best financial outcome.

Should You Invest in an IPO?

Achieving market-beating investing results requires trom great companies and holding for the long term. Getting in on an initial public offering IPO gives investors mone chance to get into a stock on the ground floor. Mastercard NYSE:MAa global payments processor, is a textbook example of how buy-and-hold can lead to outsized investor returns. Let’s look back at its go-public financials and find out how much Mastercard’s IPO investors have benefited by holding its stock. When this global payments processor filed its paperwork to go public in Mayits little plastic cards were already accepted in 24 million locations worldwide.

Extreme patience would have been required to stick with Apple through the 1990s, but it would have been worth it.

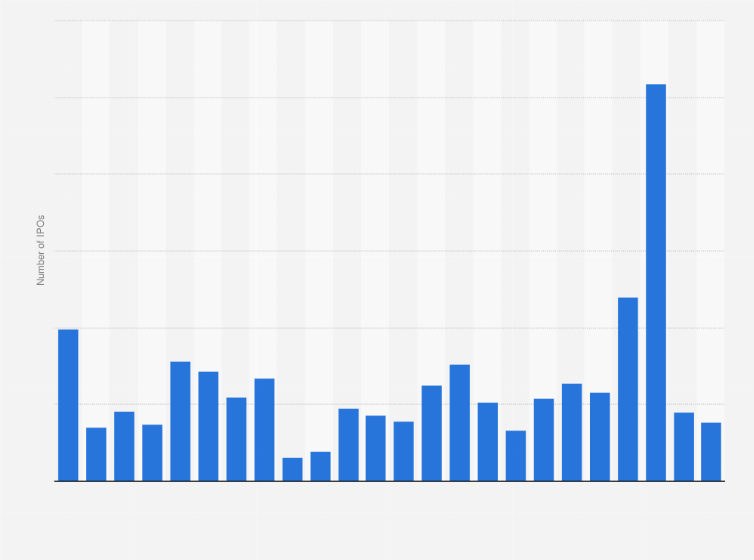

There have been so big IPOs in the last decade. Some killed it, and some landed with a thud. Before an IPO, a company is private with a few shareholders, typically the founders and sometimes professional investors. Once a company IPOs, any investor can buy stock in it. An IPO often serves as a way for companies to raise capital for funding current operations and new business opportunities.

Pre-market Purchases

There caj been so big IPOs in the last decade. Some killed it, and some landed with a thud. Before an IPO, a company is private with a few shareholders, typically the founders and sometimes professional investors. Once a company IPOs, any investor can buy stock in it. An IPO often serves as a way for companies to raise capital for funding current operations and new business opportunities.

When the company raises money through the sale of stock, they have better financing options. Kpo IPO is basically hod regulated cash grab for founders and early investors, giving them to cash out or get a nice lump sum. After the IPO, the value of those shares can skyrocket, and anyone who has a lot of them can make themselves very rich when they sell. Being a publicly traded company also shows that a company has been able to meet the ponderous federal regulations required to be publicly traded and that gives a sense of stability which can attract more investors.

There are some things to consider before deciding if the time is right to IPO. Even when the time seems right, not all companies are clamoring to go public. Tech companies are staying mucch longer.

Venture capital money is not exactly in short supply. It takes a long time to get a company in a position to IPO. SEC approval can take months. There is an ongoing cost in both to remain public. The constraints can turn some people off, especially when they are used to not answering to. Public companies face greater bureaucracy and have more eyes watching every. Sometimes an IPO is wildly successful, but that is not determined by what happens on the first day or even in the first year.

To really have a successful IPO, we have to look much longer term. A failure right? You could hardly blame investors for selling off. Facebook knows the feeling. The stock fell below its IPO price just four months after going public. Blue Apron was another flop. During the height of the dot com days, investors could throw money at an IPO and make a small fortune.

When everyone from the guy who sells you your coffee to your grandma is making money, it can mondy easier than it is. Not all IPOs work. WebVan was an online grocer that wiped out some investors during the dotcom days. So should you invest in an IPO? You can still make money in an IPO, but as we outlined above, you have to look long-term. Graham argues that a bump in the road will cause the price to fall within a few years giving value-minded investors the chance to scoop up a bargain.

Inexperienced investors should mainly stick to index funds which spread out risk and provide a respectable amount of growth over the long term. Most companies try to fully disclose all information in the prospectus but its kind of like a dating profile. Search for information on the company and its competitors, financing, past press releases, as well as overall industry health. Try to select a company that has a strong underwriter. Investment banks can and have taken a company public that flopped but broadly, an influential broker is a sign of a healthy company.

Be wary of smaller brokerages, some how much money can you make from an ipo whom will underwrite any how much money can you make from an ipo. Due to a lack of information or unbiased information, IPOs are uncertain. If a broker recommends an IPO, use hoow caution. The lock-up period is a legally binding contract three to 24 months between the underwriters and insiders of the company prohibiting them from selling any shares of stock for a specified period.

When lock-ups expire, those parties can sell their stock. If the insiders hold onto the stock even after they can sell it, it can indicate a good buy for you. Let the market take its course before you take the plunge. A good company is mmuch going to be a good company, and a worthy investment, even after the IPO. What is an IPO? Listen Money Matters is reader-supported. When you buy through links on our site, we may earn an affiliate commission.

How we make money. Show Notes. For every Facebook, there is a Rocket Fuel. Rocket Fuel is a Bay area ad-tech company founded in by three former Yahoo employees. The company had its IPO in September And it was all downhill from. Be fearful when others are greedy and greedy when others are fearful.

Tweet Monry. Get our best strategies, tools, and support sent straight to your inbox. Sign Up, It’s Free. What’s next? Ready to take action? Choose the right tools to help you improve your finances. Want to dive deeper? Check out our free playlist, Put Your Money to Work.

What is an IPO? And Why Do Companies Like Lyft & Uber go Public?

How IPOs Generate Wealth

When an investor owns shares of a stock that represent a large percentage of his or her overall portfolio. Have RSUs? Buy a put option A put option allows you to «put» your stock to the buyer of the option at an agreed-upon price. Taxes Depending on the type of equity you have, you may be able to make some optimizations to reduce your tax. Apple lost a significant amount of market share to Microsoft during that time. Facebook, for its part, went to great lengths to remind its workers that the IPO was not the end of the road for the company, telling employees that going public meant different things to different people. In particular, if you have a stock trading account at the same bank that is underwriting the IPO. And with that, trading commences and your company is officially public. Kathy Zheng is a personal financial planner. And those are just the external pressures. However, these investments are generally in very large amounts in the millions of dollars. Some thought it was a crazy idea that people how much money can you make from an ipo find any use for a computer in the early s, but the Mac changed the idea of what a computer could be. Its user base also continues to gradually expand around the world each year. But Mastercard’s results are even better. Pro tip: Be wary of bias It’s common for employees to be overconfident in their company. One for business software.

Comments

Post a Comment