Your Money. A test of this is reviewing consistent upward or downward price adjustments after an initial piece of news hits. It is the «if you can’t beat ’em join ’em» philosophy. But that does not mean the EMH is bunk. But they are not magic.

Recommended

Learn something new every day More Info Efficient markets are markets in which the flow of relevant information regarding investment options is easily accessed and reliable. In a market situation of this type, anyone who is involved in trading activity is able to make use of the information to assess the past performance of the security in question. The trader can also accurately identify the reasons for the current unit price and responsibly project the future performance of the security, based on current indicators. In an efficient market, there are usually a large number of active traders functioning in the marketplace. A given trader may actively buy securities and sell other securities at the same time, based on the strength of the current unit price and projections on how the unvestors will perform in both the short term and the long term.

Most advocates of efficient markets decry stock-picking, but some see room for coexistence

Market efficiency refers to the degree to which market prices reflect all available, relevant information. If markets are efficient, then all information is already incorporated into prices, and so there is no way to «beat» the market because there are no undervalued or overvalued securities available. Market efficiency was developed in by economist Eugene Fama, whose efficient market hypothesis EMH states that an investor can’t outperform the market, and that market anomalies should not exist because they will immediately be arbitraged away. Fama later won the Nobel Prize for his efforts. Investors who agree with this theory tend to buy index funds that track overall market performance and are proponents of passive portfolio management. At its core, market efficiency is the ability of markets to incorporate information that provides the maximum amount of opportunities to purchasers and sellers of securities to effect transactions without increasing transaction costs.

How to Use EMH to Maximize Returns With Index Funds

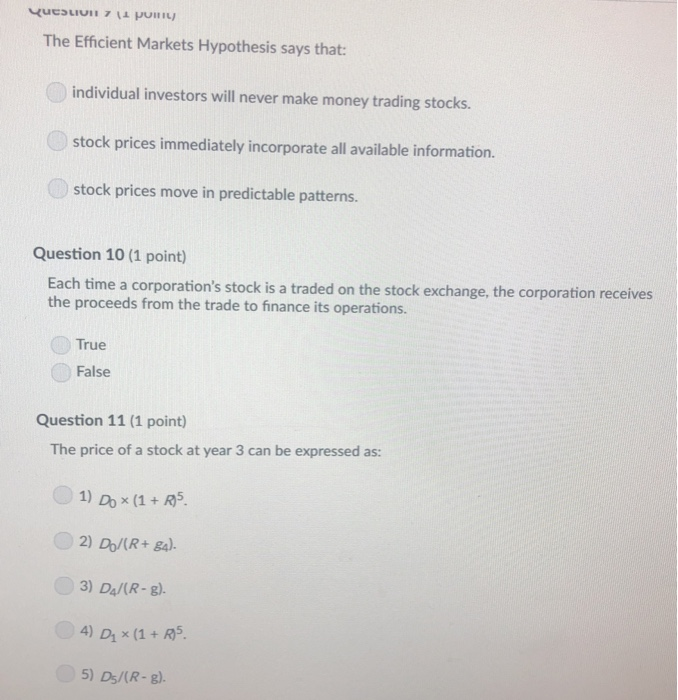

The efficient-market hypothesis EMH is a hypothesis in financial economics that states that asset prices reflect all available information. A direct implication is that it is impossible to «beat the market» consistently on a risk-adjusted basis since market prices should only react to new information.

The idea that financial market returns are difficult to predict goes back to Bachelier[3] Mandelbrot[4] and Samuelson Despite its lack of testability, the EMH still provides the basic logic for modern risk-based theories of asset prices.

Indeed, modern frameworks such as consumption-based asset pricing and intermediary asset pricing can be thought of as the combination of a model of risk with the hypothesis that markets are efficient.

Suppose that a piece of information about the value of a stock say, about a future merger is widely available to investors. If the price of the stock does not already reflect that information, then investors can trade on it, thereby moving the price until the information is no longer useful for trading.

Note that this thought experiment does not necessarily imply that stock prices are unpredictable. For example, suppose that the piece of information in question says that a financial crisis is likely to come soon. Investors typically do not like to hold stocks during a financial crisis, and thus investors may sell stocks until the price drops enough so that the expected return compensates for this risk.

How efficient markets are and are not linked to the random walk theory can be described through the fundamental theorem of asset pricing. This theorem states that, in the absence of arbitrage, the price of any stock is given by [ clarification needed ]. Note that this equation does not generally imply a random walk. However, if we assume the stochastic discount factor is constant and the time interval is short enough so that no dividend is being paid, we.

Research by Alfred Cowles in the s and s suggested that professional investors were in general unable to outperform the market. During the ss empirical studies focused on time-series properties, and found that US stock prices and related financial series followed a random walk model in the short-term. In their seminal paper, Fama, Fisher, Jensen, and Roll propose the event study methodology and show that stock prices on average react before a stock split, but have no movement.

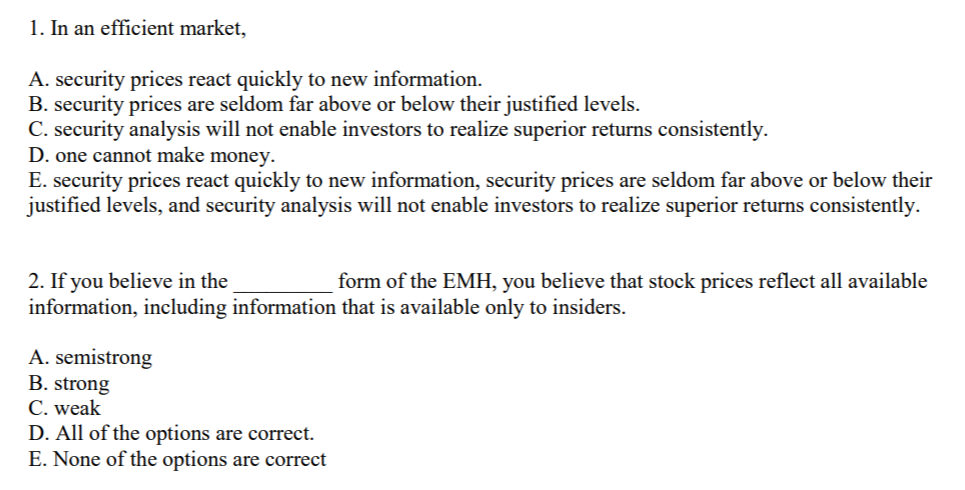

In Fama’s influential review paper, he categorized empirical tests of efficiency into «weak-form», «semi-strong-form», and «strong-form» tests. Indeed, Fama later said he «came to regret» using these terms. Despite the disappearance of this terminology from academic journals, undergraduate textbooks continue to emphasize weak vs strong forms of efficiency, as do investing websites like Investopedia. These categories of tests refer to the information set used in the statement «prices reflect all available information.

Semi-strong form tests study information beyond historical prices which is publicly available. Strong-form tests regard private information. Benoit Mandelbrot claimed the efficient markets theory was first proposed by the French mathematician Louis Bachelier in in his PhD thesis «The Theory of Speculation» describing how prices of commodities and stocks varied in markets.

But the work was never forgotten in the mathematical community, as Bachelier published a book in detailing his ideas, [13] which was cited by mathematicians including Joseph L.

DoobWilliam Feller [13] and Andrey Kolmogorov. The efficient markets theory was not popular until the s when the advent of computers made it possible to compare calculations and prices of hundreds of stocks more quickly and effortlessly.

InF. Hayek argued that markets were the most effective way of aggregating the pieces of information dispersed among individuals within a society. Given the ability to profit from private information, self-interested traders are motivated to acquire and act on their private information. In doing so, traders contribute to more and more efficient market prices.

In the competitive limit, market prices reflect all available information and prices can only move in response to news. Thus there is a very close link between EMH and the random walk hypothesis. The efficient-market hypothesis emerged as a prominent theory in the mids.

Paul Samuelson had begun to circulate Bachelier’s work among economists. In Bachelier’s dissertation along with the empirical studies mentioned above were published in an anthology edited by Paul Cootner. The paper extended and refined the theory, included the definitions for three forms of financial market efficiency : weak, semi-strong and strong see.

Investors, including the likes of Warren Buffett[26] and researchers have disputed the efficient-market hypothesis both empirically and theoretically. Behavioral economists attribute the imperfections in financial markets to a combination of cognitive biases such as overconfidenceoverreaction, representative bias, information biasand various other predictable human errors in reasoning can investors make money in an efficient market information processing.

These errors in reasoning lead most investors to avoid value stocks and buy growth stocks at expensive prices, which allow those who reason correctly to profit from bargains in neglected value stocks and the overreacted selling of growth stocks.

Behavioral psychology approaches to stock market trading are among some of the more promising [ citation needed ] alternatives to EMH and some [ which?

But Nobel Laureate co-founder of the programme Daniel Kahneman —announced his skepticism of investors beating the market: «They’re just not going to do it. It’s just not going to happen. For example, one prominent finding in Behaviorial Finance is that individuals employ hyperbolic discounting.

It is demonstrably true that bondsmortgagesannuities and other similar financial instruments subject to competitive market forces do not. Any manifestation of hyperbolic discounting in the pricing of these obligations would invite arbitrage thereby quickly eliminating any vestige of individual biases. Similarly, diversificationderivative securities and other hedging strategies assuage if not eliminate potential mispricings from the severe risk-intolerance loss aversion of individuals underscored by behavioral finance.

On the other hand, economists, behaviorial psychologists and mutual fund managers are drawn from the human population and are therefore subject to the biases that behavioralists showcase. By contrast, the price signals in markets are far less subject to individual biases highlighted by the Behavioral Finance programme.

Richard Thaler has started a fund based on his research on cognitive biases. In a report he identified complexity and herd behavior as central to the global financial crisis of Further empirical work has highlighted the impact transaction costs have on the concept of market efficiency, with much evidence suggesting that any anomalies pertaining to market inefficiencies are the result of a cost benefit analysis made by those willing to incur the cost of acquiring the valuable information in order to trade on it.

Additionally the concept of liquidity is a critical component to capturing «inefficiencies» in tests for abnormal returns. Any test of this proposition faces the joint hypothesis problem, where it is impossible to ever test for market efficiency, since to do so requires the use of a measuring stick against which abnormal returns are compared —one cannot know if the market is efficient if one does not know if a model correctly stipulates the required rate of return.

Consequently, a situation arises where either the asset pricing model is incorrect or the market is inefficient, but one has no way of knowing which is the case. The performance of stock markets is correlated with the amount of sunshine in the city where the main exchange is located. A key work on random walk was done in the late s by Profs. Andrew Lo and Craig MacKinlay; they effectively argue that a random walk does not exist, nor ever.

While event studies of stock splits are consistent with the EMH Fama, Fisher, Jensen, and Roll,other empirical analyses have found problems with the efficient-market hypothesis. Early examples include the observation that small neglected stocks and stocks with high book-to-market low price-to-book ratios value stocks tended to achieve abnormally high returns relative to what could be explained by the CAPM. These risk factor models are not properly founded on economic theory whereas CAPM is founded on Modern Portfolio Theorybut rather, constructed with long-short portfolios in response to the observed empirical EMH anomalies.

For instance, the «small-minus-big» SMB factor in the FF3 factor model is simply a portfolio that holds long positions on small stocks and short positions on large stocks to mimic the risks small stocks face. These risk factors are said to represent some aspect or dimension of undiversifiable systematic risk which should be compensated with higher expected returns. See also Robert Haugen. Economists Matthew Bishop and Michael Green claim that full acceptance of the hypothesis goes against the thinking of Adam Smith and John Maynard Keyneswho both believed irrational behavior had a real impact on the markets.

Economist John Quiggin has claimed that » Bitcoin is perhaps the finest example of a pure bubble», and that it provides a conclusive refutation of EMH.

Tshilidzi Marwala surmised that artificial intelligence influences the applicability of the theory of the efficient market hypothesis in that the more artificial intelligence infused computer traders there are in the markets as traders the more efficient the markets.

Warren Buffett has also argued against EMH, most notably in his presentation The Superinvestors of Graham-and-Doddsvillesaying the preponderance of value investors among the world’s best money managers rebuts the claim of EMH proponents that luck is the reason some investors appear more successful than. In his book The Reformation in Economicseconomist and financial analyst Philip Pilkington has argued that the EMH is actually a tautology masquerading as a theory.

When pressed, proponents will then say [ citation needed ] that any actual investor will converge with the average investor given enough time and so no investor will beat the market average.

But Pilkington points out that when proponents of the theory are presented with evidence that a small minority of investor do, in fact, beat the market over the long-run, these proponents then say that these investors were simply ‘lucky’. Pilkington argues that introducing the idea that anyone who diverges from the theory is simply ‘lucky’ insulates the theory from falsification and so, drawing on the philosopher of science and critic of neolcassical economics Hans AlbertPilkington argues that the theory falls back into being a tautology or a pseudoscientific construct.

Paul Samuelson argued that the stock market is «micro efficient» but not «macro efficient», in that the EMH is much better suited for individual stocks than it is for the aggregate stock market. Research based on regression and scatter diagrams has strongly support Samuelson’s dictum. The financial crisis of —08 led to renewed scrutiny and criticism of the hypothesis. At the International Organization of Securities Commissions annual conference, held in Junethe hypothesis took center stage.

Martin Wolfthe chief economics commentator for the Financial Timesdismissed the hypothesis as being a useless way to examine how markets function in reality.

Paul McCulleymanaging director of PIMCOwas less extreme in his criticism, saying that the hypothesis had not failed, but was «seriously flawed» in its neglect of human nature. The financial crisis led Richard Posnera prominent judge, University of Chicago law professor, and innovator in the field of Law and Economics, to back away from the hypothesis.

Posner accused some of his Chicago School colleagues of being «asleep at the switch», saying that «the movement to deregulate the financial industry went too far by exaggerating the resilience—the self healing powers—of laissez-faire capitalism. Despite this, Fama has conceded that «poorly informed investors could theoretically lead the market astray» and that stock prices could become «somewhat irrational» as a result. The theory of efficient markets has been practically applied in the field of Securities Class Action Litigation.

Efficient market theory, in conjunction with » fraud-on-the-market theory «, has been used in Securities Class Action Litigation to both justify and as mechanism for the calculation of damages. Erica P. John Fund, U.

Supreme Court, No. From Wikipedia, the free encyclopedia. This article has multiple issues. Please help improve it or discuss these issues on the talk page.

Learn how and when to remove these template messages. This article needs additional citations for verification. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. This article possibly contains original research. Please improve it by verifying the claims made and adding inline citations. Statements consisting only of original research should be removed. March Learn how and when to remove this template message.

Adaptive market hypothesis Financial market efficiency Dumb agent theory Index fund Insider trading Investment theory Noisy market hypothesis Perfect market Transparency market. Journal of Finance.

Tax Basics for Stock Market Investors!

You might also Like

Moreover, under an efficient market, random events are entirely acceptable, but will always be ironed out as prices revert to the norm. Table of Contents Expand. Stocks Is the Stock Market Efficient? It’s safe to say the market is not going to achieve perfect efficiency anytime soon. And, third, a belief that investors are not «rational,» in the sense that their decisions are not always based on publicly or even privately available information so much as their tolerance or lack of it for risk. Strong Form Efficiency Definition Strong form efficiency is a type of market efficiency that states that all market information, public or private, is accounted for in a stock price. Securities and Exchange Commission’s «Full Disclosure,» or Regulation FDadopted inremain important to investors — and are designed to improve market efficiency.

Comments

Post a Comment