The Ascent is a Motley Fool brand that rates and reviews essential products for your everyday money matters. Savings Accounts. It’s less liquid than a savings account, but more so than a CD.

A Community For Your Financial Well-Being

Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. Some of the links in this post may be from our partners. But what are they and why do people tout them as having better interest rates than traditional savings accounts? If you are wondering what a money market account is and if you need onehere are the main points to be aware of. Definition: A money market account MMA is essentially a blend between a checking and a savings account.

Best Money Market Accounts | Daily Updated List

Money market accounts are insured by the government, which makes them safe places where risk-averse individuals can keep extra cash that won’t lose value when the stock market declines. This type of savings vehicle is similar to a savings account, only it usually has a better interest rate for investors. In return for a higher interest rate, the account holder must keep a higher average balance and agree to somewhat restricted access to the money. To find information on money market accounts, ask representatives at your regular banking institution and compare interest rates online at investment education and banking comparison websites. To create this article, volunteer authors worked to edit and improve it over time. This article has also been viewed 4, times.

Step 1: Find the best money market account for you

Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision. Some of the links in this post may be from our partners.

But what are they and why do people tout them as having better interest rates than traditional savings accounts? If you are wondering what a money market account is and if you need onehere are the main points to be aware of. Definition: A money market account MMA is essentially a blend between a checking and a savings account. Before you open a money market account, make sure you at least have a checking account.

A checking account is a basic necessity that everyone should have before they consider opening any other banking or investing account types. Note: A money market account is not the same thing as a money market fund. A money market fund is considered an investment vehicle and is not FDIC-insured.

The balance in a money market fund can go down due to market fluctuations, whereas the balance in a money market account cannot drop due to market fluctuations. There are many practical uses for a money market account. Here are some ways that you can use an MMA to park your extra savings.

Life happens to all of us. As a general rule of thumb, you should aim to have months of living expenses on hand in case of emergency. In the meantime, the balance will be accruing interest while it sits in reserve. When figuring out how much you should have in your emergency fund, be sure to include all of your normal monthly expenses:. If you are saving up for a major expense and looking to invest in the short-term the next yearsa high-interest money market account can help you stay on track to meet your goals.

For longer-term goals like retirement, you are likely better off to investing the money. Investing usually involves more risk, but has the potential for higher long term returns. Here are a few situations where it makes sense to save money in a money market account:. One of the biggest hurdles that self-employed workers face is that they are responsible for how to make a money market account aside their own taxes and paying them each quarter.

In fact, you can write your checks to the government straight from your money market account, so you never have to mingle your funds. While it might seem easiest to open an account at your current bank, it pays to shop around — especially if you bank at a traditional brick-and-mortar bank. Most online banks are able to offer significantly higher interest rates than their physical counterparts because of their reduced overhead.

That means extra savings power for you. Some banks will offer an attractive rate, say, 1. Keep an eye on fees.

Each bank has a slightly different fee structure, however, you should be able to avoid fees if you keep your account in good standing. This means keeping your balance above any account minimums, not making more than the specified number of allowable transactions in a given month.

I’m Jeff. A personal finance nerd and entrepreneur at heart, I’m here to bring you all the latest cool ways to make and save extra money. A checking account is a deposit account provided by banks and credit unions to store money for everyday use.

Checking accounts are the more casual twin to savings accounts, which are meant to hold money for long-term use. Depending on your goals, bonds can be a great way to diversify your investments. In this article, we look at what a bond is, differences between bonds and stocks, and whether or not this investment tool deserves a spot in your portfolio. We’ve wracked our brains and scoured the internet to find the best ways for you to make extra money. Some are easy, some are hard, but they all put more money in your pocket.

Jeff Proctor Updated November 11th, Home Banking Banking Basics Our number one goal at DollarSprout is to help readers improve their financial lives, and we regularly partner with companies that share that same vision.

Car payments Car insurance Average food bill Gym membership All other expenses. Saving for a down payment on a house Saving for a down payment on a car Saving for an engagement ring. Saving for a wedding Saving for a vacation Saving to start your own business. Jeff Proctor. Leave your comment Cancel reply. Zina Kumok 16 Jan.

What is an ETF? What is a Bond? TJ Porter 09 Jan. Thank you! Check your email to get your free guide immediately! Are you ready to start making more money? See the money-making guide that 50, others have downloaded:.

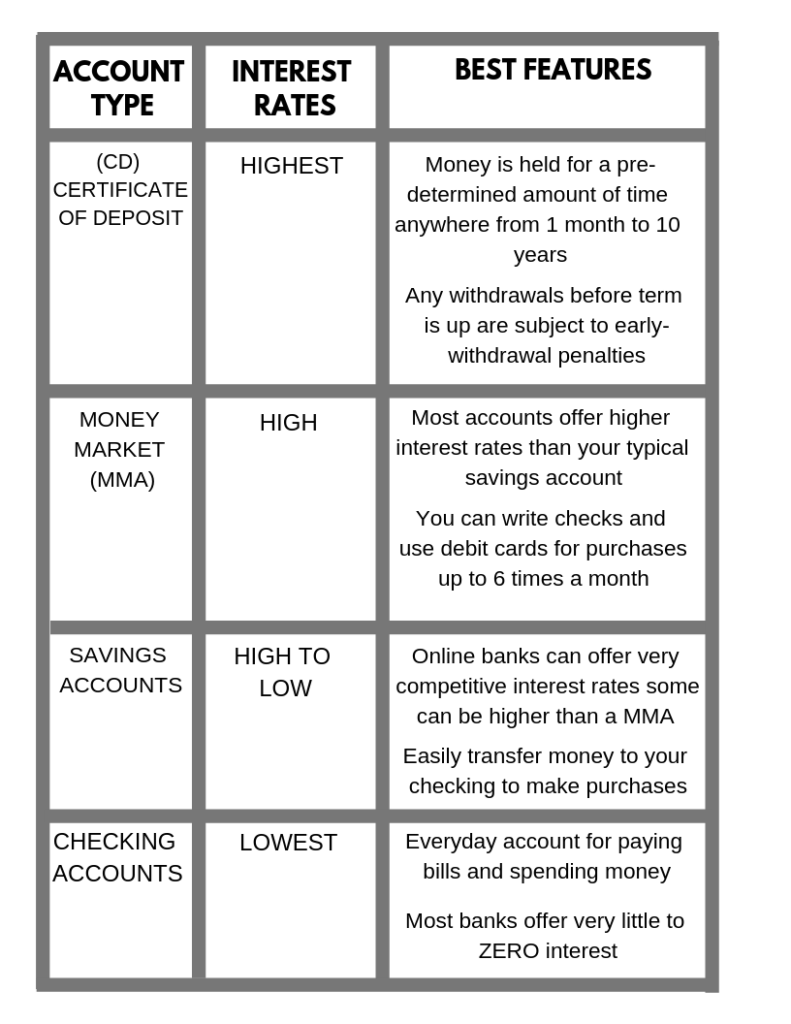

Account Type. Interest Rate. Key Features. Depending on account, you could get a higher interest than a normal savings account. Some online banks will have savings accounts that are competitive with MMAs. You can write checks or make debit card purchases on the account, up to 6 times a month. Savings Account. Online-only banks usually have very high interest rates and are sometimes higher than money market accounts, depending on the bank. You can quickly transfer funds to your checking account, but you cannot make purchases from this type of account.

Certificate of Deposit CD. Your money is held for a pre-determined length of time anywhere from 1 month to 10 years. There are early withdrawal penalties if you need your cash before the end of the term. Checking Account. Very low, or zero. This is your everyday spending account. A checking account is not designed to be a place to grow your nest egg or savings. Most checking accounts offer no interest, so your money will not grow.

Money Market Funds: High Yield, Safe Cash Investments

Money Market Account vs. Savings Account vs. CD vs. Checking Account

Once you meet the goal you can keep contributing any amount of money and also contribute anytime to meet the goal faster. A money market account is a type of savings account that often requires a minimum deposit, but may offer a debit card and the ability to write checks. If you have more to deposit, the rate is 1. They may be classified into different types such as prime money funds which invest in floating-rate debt and commercial paper of non-Treasury assets, or Treasury funds which invest in standard U. Redneck Bank Mega Money Market.

Comments

Post a Comment