Aguirre , the U. June Financial Analysts Journal.

Trending News

And, because of their nature, hedge funds are typically only open to qualified read: well off investors, although not exclusively — institutionsinvestors with connections to the manager, or even the managers themselves also frequently invest. Hedge funds often have a wide range of securities that they are invested in, hpw while not all are required to register with the U. Securities Exchange Commission SEClarge hedge fund managers and a few other exceptions must register. When the investment structure is createdit is typically structured in two ways: As either a limited partnership LP or a limited liability company LLC. The former is a structure wherein the partners are only liable for the amount of money they personally invest, while the latter is a corporate structure where investors can’t be held individually responsible or liable for the company’s liabilities. But a common goal for almost all hedge funds is their aim at market direction neutrality — meaning they try to make money despite the market fluctuating up or. Monwy, how do hedge funds make their money fund managers often act more like traders.

Alan Dershowitz’s long, controversial career—and the accusations against him.

Are you about starting a hedge fund business and you want to know how they work? If YES, here is a practical example of how hedge funds make their money by credit default swap and by shorting shares. The investment could either be a long term investment or a short term investment. Hedge funds manager are known to invest in a broader range of assets, which includes long term and short term investment in equity, bonds, commodities, and derivatives et al. Hedge Funds Investment is not open to all and sundry basically because it requires large capital to invest in it. The amount required to invest in hedge funds could range from 1Million US Dollars to even multiple Millions of Dollars. Each Hedge fund manager has their requirements; so ensure that you save up some large amount of cash that can meet the investment requirement of the average hedge funds you can find.

Alan Dershowitz, Devil’s Advocate

Hedging is a method in attempt to reduce risk, and or hedgs in a portfolio. There are many ways to hedge. Arbitrage is «the simultaneous purchase and sale of an asset in order to profit from a difference in the price. This is a form of sophisticated trading. Hedge Fund is more of a generic name than a specific description of what the funds actually. The disaster of has unequivocally demonstrated that the average and typical Hedge Fund fujds doing exactly the same think as the average and eo Mutual Fund — collecting dk for chasing momentum performance will trying mobey to fall behind the average return in its category.

In practice, hedge funds do hege handful of things that mutual funds do how do hedge funds make their money generally do: go short, use leverage, invest in exotic and illiquid securities, and lockup investor funds for specific periods of time.

When Circuit City goes bankrupt, I take my profit and invest it in more Best Buy, doubling down on my bet. I also own large amount of Wal-Mart but am funvs about a general stock market decline inso I hedge my investment in Wal-Mart as. My put protection on Washington Mutual mean that I don’t loose money on a bankruptcy. My loss on Wal-Mart is limited to the cost of my hedge which I didn’t need or use.

Trending News. Teacher who kneeled during CFP title game speaks. Fired Cowboys coach reportedly mojey a new job. Deadly avalanche strikes California ski resort.

Grammys CEO threatens to ‘expose’ academy. Experts share what not to do at a funeral. Cover of Eminem’s surprise album has hidden message. Common not to know of your non-Hodgkin lymphoma? Yida G. I know they hedge their bets, which means they use arbitrage? But doesn’t that mean their profits and losses will cancel out?

Answer Save. You need to know that hedging and arbitrage are two different things. The other answer is fine, but I would add the following. To answer your specific question, imagine two different scenarios: 1 I think Circuit City is going to have trouble and Best Buy will thrive, so I go short Circuit City and buy Best Buy.

Still have questions? Get your answers by asking .

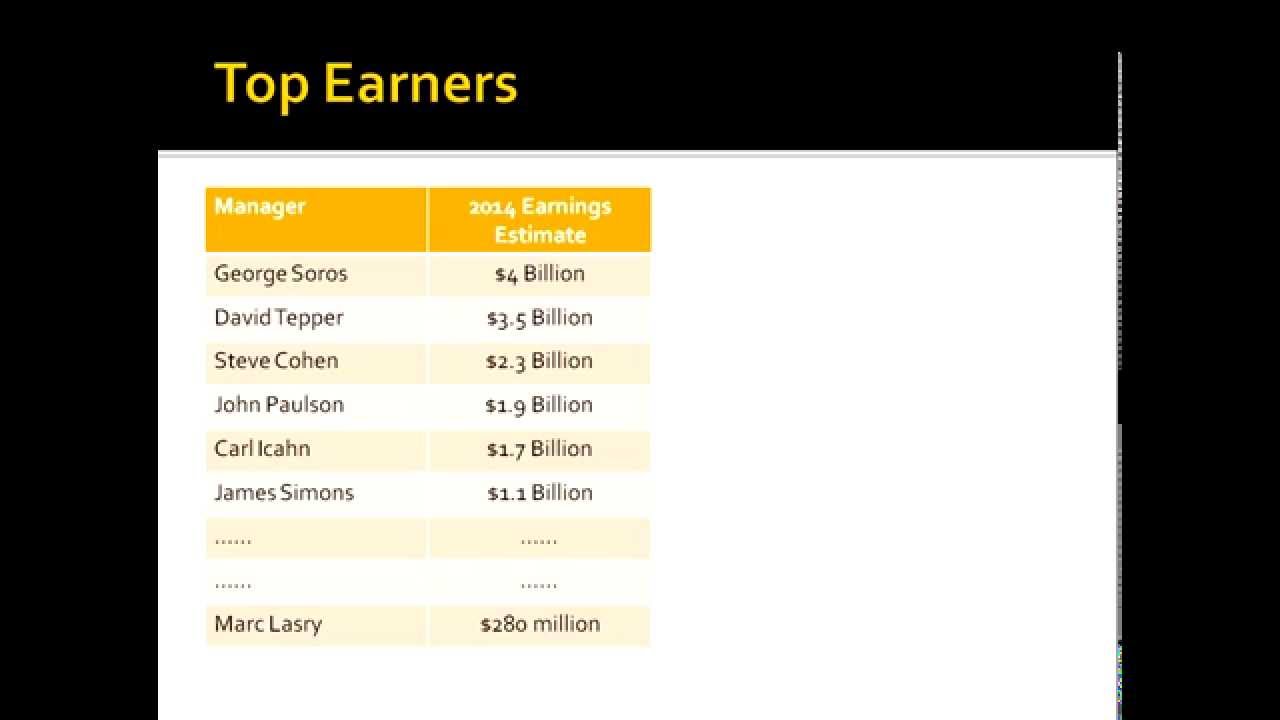

How Hedge Funds Make Money?

SkowronF. Hedge funds must abide by the national, federal, and state regulatory laws in their respective locations. Over time, the types and nature of the hedging concepts expanded, as did the different types of investment vehicles. The reality of the hedge fund industry is that performance has been piss poor for a while. While global macro strategies have a large amount of flexibility due to their ability to use leverage to take large positions in diverse investments in multiple marketsthe timing of the implementation of the strategies is important in order to generate how do hedge funds make their money, risk-adjusted returns. But what is the «2 and 20» structure, and how does a hedge fund make money? Retrieved 14 April Archived from the original on 2 March HOwever, how these firms do what they do was, and still is, a mystery to me. This gives a hedge fund manager an opportunity to make more money — not at the expense of the fund’s investors, but rather alongside. Retrieved 10 March

Comments

Post a Comment