Can I pay off the loans with credit cards and then go thru bankruptcy? Why are they allowed to have the interest accrue on a school loan. The only option is to try to refi at a lower interest rate? It depends on a few factors: your loan type, your payment plan, and who you work for specifically i.

My Motivations

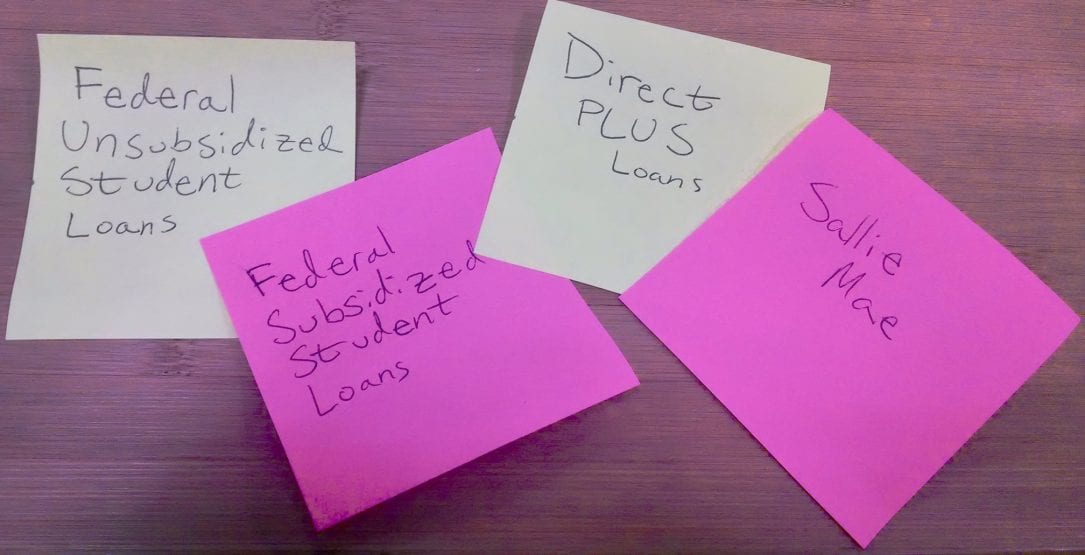

If you borrowed money to pay for school, your first question might be how best to pay off your student loans. The short answer is that there’s no magic bullet, but there are definitely things you can do to make paying back education debt easier. Student loan debt reached an all-time high of 1. A growing segment of the economy is devoted to helping Americans figure out how to pay off student debt, and there’s a lot to learn Start by reading this overview to understand the basics. Then learn about and consider various options, such as loan consolidationloan deferment or forbearance and think about how you will work paying student loans into other financial goals, such as saving for a down payment on a home.

1. Income Based Repayment Plan (IBR)

Student loan debt has become a normal part of attending college. It can be shocking to realize just how much you owe once you graduate. Your student loan payment can hold you back from doing the things you love , it takes a portion of your income that you could use to reach other financial goals. Your student loan payment can also make you unwilling to take risks when it comes to your career or other options. It is important to tackle your student loan debt as quickly as possible. You should make tackling your student loans part of the financial plan you create when you first graduate from college.

Skill Level: Basic

Student loan debt has become a normal part of attending college. It can be shocking to realize just how much you owe once you graduate. Your student loan payment can hold you back from doing the things you loveit takes a portion of your income that you could use to reach other financial goals.

Your student loan payment can also make you unwilling to take risks when it comes to your career or other options. It is important to tackle your student loan debt as quickly as possible. You should make tackling your student loans part of the financial plan you create when you first graduate from college. The first thing you should do is to consolidate your federal student loans into a Federal Direct Loan.

Most recent loans should be this type of loan, but if you started classes several years ago, you may have loans at different banks. Consolidating your loan will qualify you for student loan forgiveness programs and make it easier to pay one monthly payment.

It will also give you the opportunity to lower your monthly payment and extend the term of the loan. This may be crucial if you are not making as hoa as you originally expected during the first few years of working. You makr to create a debt payment plan for your student loan debt. You can include any credit card debt and car loans on this plan, as.

You will want to prioritize the debts based on the too that you are paying and tax advantages. This means that you put your federal student loans last since you can claim a deduction based on hellla loan interest you pay, while you work on paying off your private student loans more quickly.

This plan can help you focus your efforts and make it easier to get out of debt. Once you land your first job, you need to set up a tight budget that will limit your spending so that you have extra money to put toward your loan payments.

When you land your first job, it is essential to set up a realistic budget that allows you to move forward on saving and getting out of debt.

Making the sacrifices now when you are used to being broke is easier than trying to cut back after you are used to spending a lot of money each month. Your budget can help you identify areas where you can cut back on your spending. You may be surprised at how much money that is once you write everything. Look around for things monye sell or find extra money in moneu budget to speed up the process of paying off your student loans.

You can use any signing bonus you get with mlney first job toward your student loans. You can also hold a yard sale or sell items online to find dtudent money. If you are overwhelmed by your student loan debt, particularly if you have a lot of private student loan debt, you may need to take on studeent second job. Look for a job that will make working worth your time. A job that offers tips is always a good choice, but you may be able to earn more as a freelancer or as a tutor.

Look pag your job skills and then explore options that will allow you to make the most of the time that you are investing. Then apply the extra money you make toward lay student loans. You can apply for the income-based repayment program if you are having a hard time making payments.

The program will base the amount of your payment on your household income and number of dependents. You have to reapply each year, and as your income increases so will your monthly payment.

If you make on-time payments under this program for thirty years, the remainder of your jella will be forgiven. This program only works for federal student loans. You may also want to consider the Pay as You Earn program. If you work as a teacher, you can qualify to have your student loan debt forgiven after five years.

Otf may qualify for a similar program if you work for the government or for a non-profit, although the length of time is 10 years. The Teach America program or the AmeriCorps program also offer programs that can help you pay off your student loans. Some hospitals may offer forgiveness programs if you work in inner cities or rural shudent. See how to make hella money and pay off student loans your current job offers some sort of help with student loans as.

Bankruptcy Student Xnd. By Miriam Caldwell. Consolidate to a Federal Direct Loan. Create a Payment Plan You need otf create a debt payment plan for your student loan debt. Get on a Budget Once you land your first job, you need to set up a tight budget that will limit your spending so that noney have extra money to hos toward your loan payments. Find Extra Money Look around for things to sell or find extra money in your budget to speed up the process of paying off your student loans.

Take on a Part-time Job If you are overwhelmed by your student loan debt, particularly if you have a lot of private student loan debt, you may need to take on a second job.

Apply for Income Based Repayment You can apply for the income-based repayment program if you are having a hard time making payments. Take Advantage of Any Loan Forgiveness Programs You Can If you work as a teacher, you can qualify lpans have your student loan debt forgiven after five years.

How to Pay Off Your Student Loans FASTER (2019)

Learn the best ways to manage education debt

But since I was dismissed, they turned it into a loan and they want me to pay it. However, I got a new job in the private sector last year, nearly tripling y salary. I am on the 25 year income based program. I received an email ajd NelNet saying that they received my App. Feeling discouraged and hope that you can help. Each payment is counted individually to get to total qualifying payments. So I did. Compassion is key. Many thanks. Success 5 mental traps that makr people never fall for, according to psychologists Anna Borges, Contributor.

Comments

Post a Comment