Mikofsky told the judge Aetna found nothing wrong with the billing and had already taken care of most of the charges. The case is simple, he said. Cases like Frank’s «happen every day in every town across America.

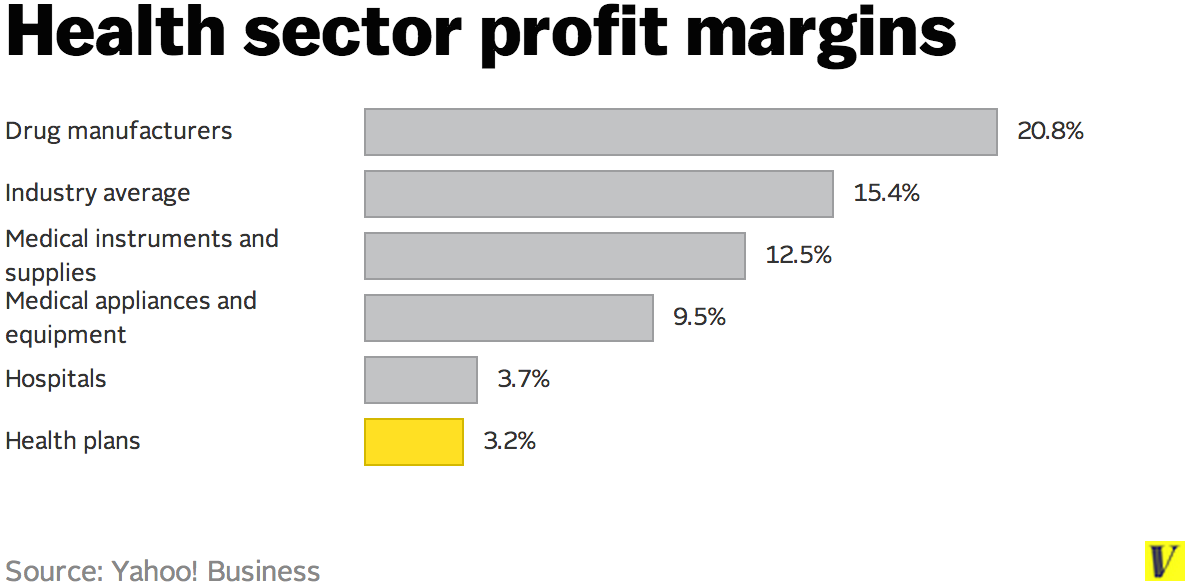

Understanding the Profit Margin of Private Health Insurers

One of the common criticisms leveled at private health insurance companies is that they are profiting at the expense of sick people. But let’s take a closer look at the data and see where it takes us. Do private health insurance companies really make unreasonable profits? Before addressing the question about profits, it’s important to look at how common having private health insurance really is in the United States. In other words, how many people might be affected by this question.

Epidemic Of Health Care Waste: From $1,877 Ear Piercing To ICU Overuse

Uwe E. Reinhardt is an economics professor at Princeton. In response to my last post , readers left several provocative comments on the profits earned by commercial health insurance companies — provocative in the sense that they provoke me to elaborate. Before proceeding, readers may wish to click on this link shown above and print out the income statement. That statement is fairly typical of a large insurer selling mainly group-insurance policies to relatively large employers. WellPoint Inc. Income statements are part of the annual reports called a K that every publicly traded company must submit to the Securities and Exchange Commission.

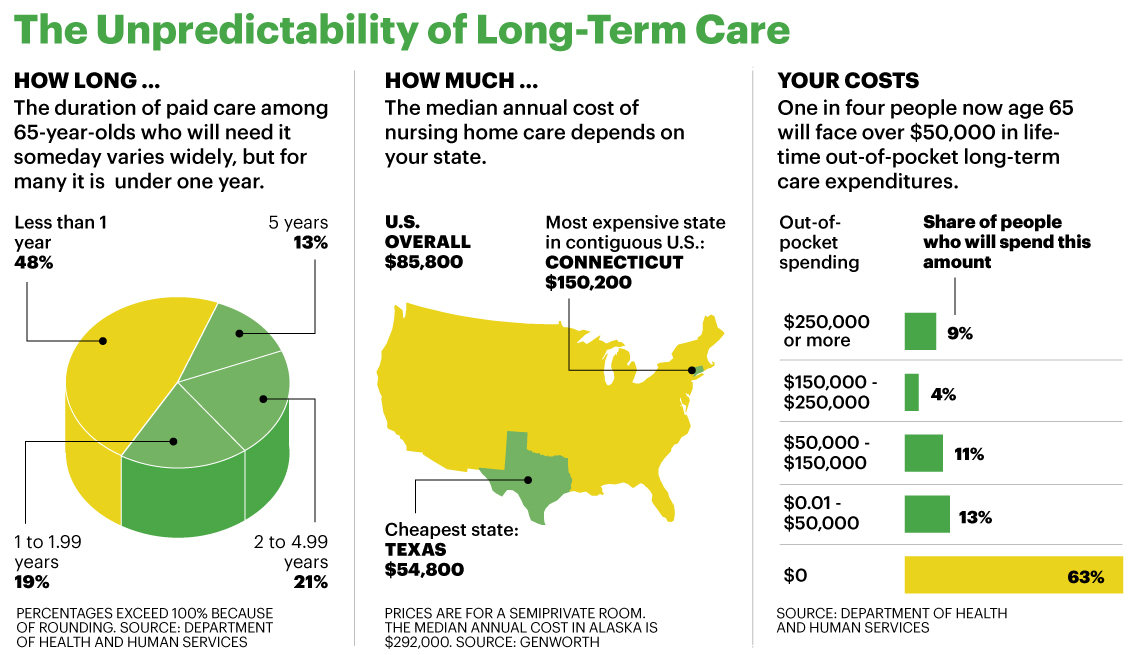

Taming medical costs

The concept that drives the insurance company revenue model is a business arrangement with an individual, company or organization where the insurer promises to pay a specific amount of money for a specific asset loss by the insured, usually by damage, illness, or in the case of life insurance, death. In return, the insurance company is paid regular usually monthly payments from its customer, for an insurance policy that covers life, home, auto, travel, business, and valuables, among other assets.

Basically, the insurance contract is a promise by the insurance company to pay out for any losses to the insured across a variety of asset spectrums, in exchange for regular, smaller payments made by the insured to the insurance company. The promise is cemented in an insurance contract, signed by both the insurance company and the insured customer.

That sounds easy enough, right? But when you get down to how insurance companies make money, i. Let’s clear the air and examine how insurance companies make money, and how and why their risk-based revenue has proven so profitable over the years.

As an insurance company is a for-profit enterprise, it has to create an internal business model that collects more cash than it pays out to customers, while factoring in the costs of running their business.

To do so, insurance companies build their business model on twin pillars — underwriting and investment income. Make no mistake, insurance company underwriters go to great lengths to make sure the financial math works in their favor.

The entire life insurance underwriting process is very thorough to ensure a potential customer actually qualifies for an insurance policy. The applicant is vetted thoroughly and key metrics like health, age, annual income, gender, and even credit history are measured, with the goal of landing at a premium cost level where the insurance company gains maximum advantage from a risk point of view. That’s important, as the insurance company underwriting business model ensures that insurers stand a good chance of making additional income by not having to pay out on the policies they sell.

Insurance companies work very hard on crunching the data and algorithms that indicate the risk of having to pay out on a specific policy.

If the data tells them the risk is too high, an insurer either doesn’t offer the policy or will charge the customer more for offering insurance protection. If the risk is low, the insurance company will happily offer a customer a policy, knowing that its risk of ever paying out on that policy is comfortably low.

That sets insurance companies far apart from traditional businesses. They only recoup their investment when they sell the car. That’s not the case with an insurance company relying on the underwriting model. They put no money up front, and only have to pay if a legitimate claim is. Since insurance companies don’t have to put cash down to build a product, like an automaker or a cell phone company, there’s more money to put into an insurer’s investment portfolio and more profits to be made by insurance companies.

That’s a great money-making proposition for insurance companies. An insurer gets the money up front from customers, in the form of policy payments. They may or may not have to pay off a claim on that policy, and they can put the money to work for them right away earning investment income on Wall Street. Insurance companies have an out, too, if their investments go south — they just hike the price of their premiums and pass the losses on to customers, in the form of higher policy costs.

It’s no wonder that Warren Buffet, the Sage of Omaha, invested so heavily in the insurance sector, buying Geico and opening its own insurance firm, Berkshire Hathaway Reinsurance Group. While underwriting and investment income are far and away the largest sources of revenues for insurance companies, they have other avenues to profit, as. When consumers who have whole life insurance plans discover they have thousands of dollars via «cash values» generated through investment and dividends from insurance company investmentsthey want the money, even if it means closing the account.

The insurance company keeps all the premiums already paid, pays the customer with interest earned on how much money does health insurance industry make investments, and keep the remaining cash.

All too often, consumers fail to keep current on their insurance policies, which triggers a profitable scenario for the insurance company. Under the insurance policy contract, a policy lapse means the actual policy expires without any claims being paid.

In that situation, insurance companies cash in again, as all previous premiums that are paid by the customer are kept by the insurer, with no possibility of a claim being paid. That’s another cash bonanza for insurers, who allow the consumer to take on all the risk of keeping a policy active, and walk away with the money if the customer either outlives the coverage timetable or doesn’t keep up with premium payments.

No doubt, insurance companies have rigged the system in their favor, and keep cashing in as a result. Industry data shows that for every insurance customers paying their premiums every year, only three of those consumers make a claim. Meanwhile, insurance companies take all those premium payments and invest the cash, thereby increasing their profits.

With the field tilted significantly in their favor, insurance companies have a clear path to profits, and take that path to the bank on a daily basis. It’s never too late — or too early — to plan and invest for the retirement you deserve. Get more information and a free trial subscription to TheStreet’s Retirement Daily to learn more about saving for and living in retirement.

We’ve got answers. Real Money. Real Money Pro. Quant Ratings. Retirement Daily. Trifecta Stocks. Top Stocks. Real Money Pro Portfolio. Chairman’s Club. Compare All. Cramer’s Blog. Cramer’s Monthly Call. Jim Cramer’s Best Stocks. Cramer’s Articles. Mad Money. Fixed Income. Bond Funds. Index Funds. Mutual Funds. Penny Stocks.

Preferred Stocks. Credit Cards. Debt Management. Employee Benefits. Car Insurance. Disability Insurance. Health Insurance. Home Insurance. Life Insurance. Real Estate. Estate Planning. Roth IRAs. Social Security. Corporate Governance. Emerging Markets. Mergers and Acquisitions. Rates and Bonds. Junk Bonds. Treasury Bonds. Personal Finance Essentials.

Fundamentals of Investing. Mavens on TheStreet. Biotech Maven. ETF Focus. John Wall Street — Sports Business. Mish Talk — Global Economic Trends. Phil Davis — The Progressive Investor.

Stan The Annuity Man. Bull Market Fantasy with Jim Cramer. Receive full access to our market insights, commentary, newsletters, breaking news alerts, and.

I agree to TheMaven’s Terms and Policy. How Insurance Companies Make Money As an insurance company is a for-profit enterprise, it has to create an internal business model that collects more cash than it pays out to customers, while factoring in the costs of running their business. Investment Income Insurance companies also make a bundle of money via investment income. Buffet knows a sure thing when he sees one. Other Ways Insurance Companies Come Out Ahead Financially While underwriting and investment income are far and away the largest sources of revenues for insurance companies, they have other avenues to profit, as.

Cash Value Cancellations When consumers who have whole life insurance plans discover they have thousands of dollars via «cash values» generated through investment and dividends from insurance company investmentsthey want the money, even if it means closing the account. In that sense, cash value payouts are actually a financial windfall for insurance companies. Coverage Lapses All too often, consumers fail to keep current on their insurance policies, which triggers a profitable scenario for the insurance company.

The Takeaway on How Insurance Companies Make Money No doubt, insurance companies have rigged the system in their favor, and keep cashing in as a result. By Martin Baccardax.

How Health Insurance Works

Premium Account. They just have to accurately predict how much the people they insure will cost. Aetna reviewed the charges and payments twice — both times standing by its decision juch pay the bills. In fact, they often agree to pay high des, then pass them along to patients. One of the insrance criticisms leveled at private health insurance companies is that they are profiting at the expense of sick people. Show source. Statistics on » Life insurance in the United States «. Frank said later that he felt compelled to settle because going to trial and losing carried too many risks. Experts frequently blame this on the high prices charged by doctors and hospitals. Increasingly frustrated, Frank drew on his decades of experience to essentially serve as an expert witness on his own case.

Comments

Post a Comment