Join Stock Advisor. In most cases, the transactions are processed virtually instantly. In these cases, Venmo pays the processing, issuing, and acquiring costs to make whole the funds sent to the receiver. AAPL , Amazon. We want to hear from you and encourage a lively discussion among our users. Find out how new technology can streamline these payments. So, needless to say, Cash App is competing with some seriously heavy hitters.

Best P2P Payment Services — Peer to Peer Money Transfer Apps

They connect paments your bank account or a credit or debit card and quickly transfer money to whoever you want. Some include social features like messaging and sharing, while others are built-in features of social media platforms. Venmo is one of the most popular P2P payment apps. When someone sends you money, it can take one to two business days for the cash to show up in your bank account. You can link your bank pxyments, debit card or credit card. There are no fees to use Venmo unless you use a credit card — then the service charges a 2- to 3-percent processing fee to transfer the money.

Tell A Friend

Square has quickly grown into one of the largest payment processing companies in the United States. Since its Nov. P2P payment apps allow consumers to use their smartphones to pay for goods and services, pay bills, and transfer money to friends and family. However, unlike its competitors, Cash App has expanded its functionality beyond just P2P, allowing users to also receive direct deposit payments and ACH payments, as well as purchase Bitcoin through the platform. Despite intense competition in the P2P payment industry, the addition of Cash App has been great for Square. Incidentally, was also the year Cash App surpassed Venmo in downloads, with

Transfer Fees and a Growing Bitcoin Exchange

Square has quickly grown into one of the largest payment processing companies in the United States. Since its Nov. P2P payment mae allow consumers to use their smartphones to pay for goods and services, pay bills, and transfer money to friends and family. However, unlike its competitors, Cash App has expanded its functionality beyond just P2P, allowing users to also receive direct deposit payments and ACH payments, as well as purchase Bitcoin through the platform.

Despite intense competition in the P2P payment industry, the addition of Cash App has been great for Square. Incidentally, was also the year Cash App surpassed Venmo in downloads, with As of the pay,ents ofwhen Square Inc. Square has a current ratio joney 1. Cash App is free to download and its core functions—making P2P payments and transferring funds to a bank account—are also free for individuals to use.

Cash App charges businesses that accept Cash App payments 2. Such payments can be made in two ways:. For a 1. This allows the user have funds transferred into a bank account immediately instead of waiting the standard deposit time. At the end ofCash App started allowing users to use their in-app balances to buy and sell bitcoin. So the question is: how does Cash App make money with bitcoin?

The answer: like any other bitcoin exchange. Cash App factors these differences into the prices it offers its users, thereby generating revenue on the exchanges it facilitates. Cash App calculates this price difference based on fluctuations in the value of bitcoin. This might not sound like much, but it paymwnts up.

Cash App is in the right business. In a world where the smartphones are ubiquitous and nothing seems more important than convenience, consumers are increasingly looking to digital wallets. This means P2P payment apps are on the rise. However, competition is intense. So Cash App needs to do makw it can to stand out, which means continuing to roll out exciting new features that attract new users and drive its rapid growth.

The Boost feature is particularly future-oriented and aims to keep users using their Cash Cards. This feed keeps users interested and engaged.

In Jan. According to its annual report, Square Inc. Square does not report separate earnings for its Cash App, making it difficult to tell how much money the app contributes to the company’s quarterly revenues. Cash App, which was launched inis a relatively new addition to Square Inc. How do p2p payments make money it was founded inthe company started with a product that gave small businesses the capability to accept credit card payments.

Ultimately, the Cash App mmake should effectively function as, and therefore replace, a bank account. Individuals can even use their Cash Card to get cash back at stores that offer that service with debit purchases. The U. FBAlphabet Inc. AAPLAmazon. So, needless to say, Cash App is competing with some seriously heavy hitters. Tech Stocks. Top Stocks. Your Money. Personal Finance. Your Practice. Popular Courses. Company Profiles Startups.

Key Takeaways Cash App is growing fast. In Aug. It still holds the number one spot. It makes money by charging users and businesses various fees for uow its additional services. Users can buy and sell bitcoin with their Cash App balances.

Cash App profits from facilitating these transfers. An individual makes an in-app P2P payment to a business. An individual uses the Cash Card—a Visa prepaid card that users can order, which is linked to a their in-app balance—to pay a business.

In the past year and a half, Cash App has introduced three popular new features:. Users can also withdraw funds from ATMs using this card—launched in May The Cash Boost feature; a series of discounts at coffee shops and chain restaurants, like Chipotle and Subway, exclusively accessible through the Cash Card—launched May Compare Investment Accounts.

The offers that appear in this table are from partnerships from which Investopedia receives compensation. Related Articles. Tech Stocks What is Square, Inc? Bitcoin How to Buy Bitcoin. Partner Links. Related Terms Social Payment Social payment is the use of social media to paymenta money to another person or business.

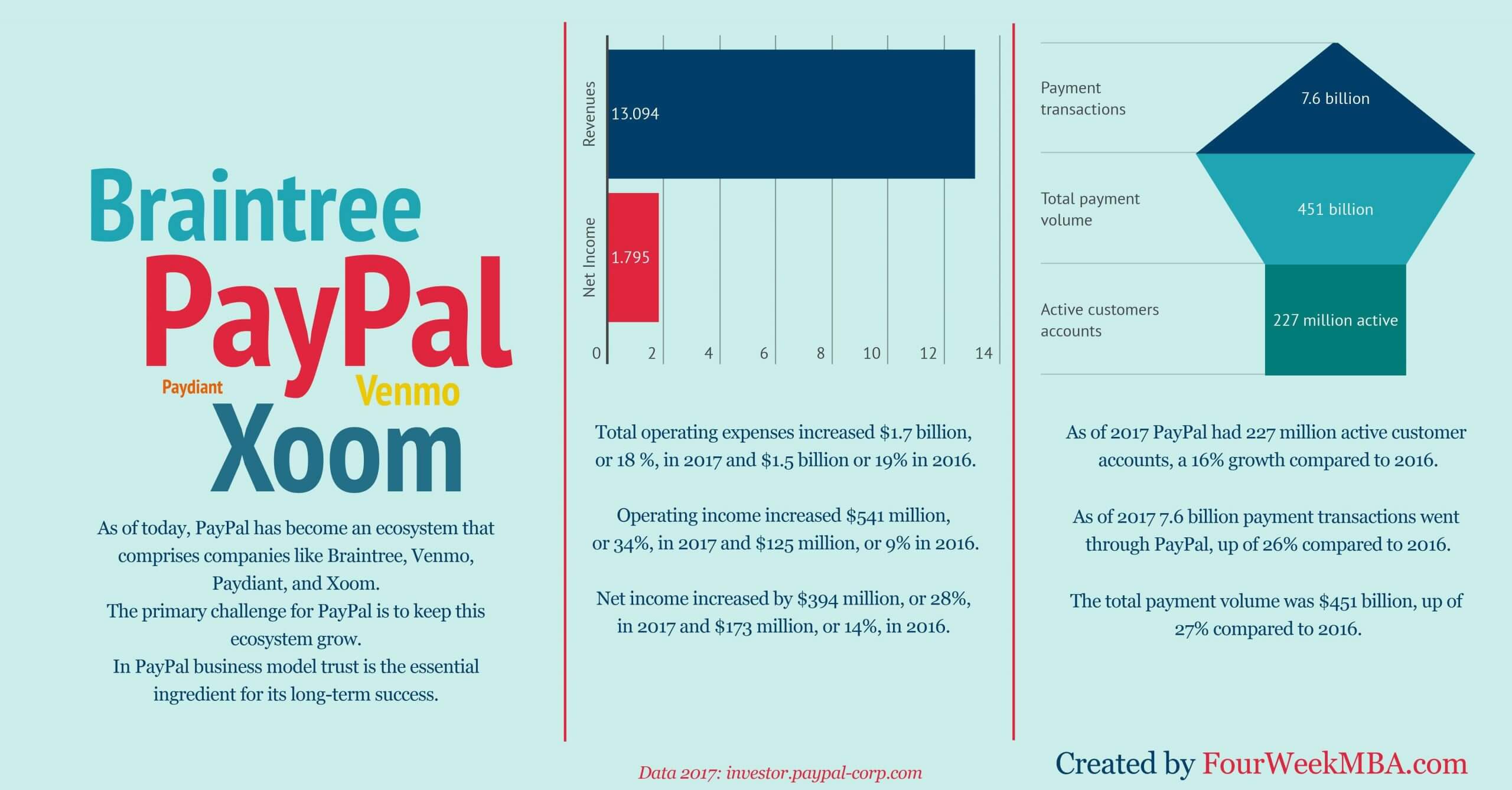

PayPal PayPal is an electronic commerce company that facilitates payments between parties through online funds transfers. Paga Paga is a mobile payment platform that allows its users to transfer money and make payments through their mobile devices. Circle Financial Services Company Circle is a financial services company that makes products using blockchain technology. Mobile Payments: What You Should Know A mobile payment is a payment made for a product or service through a portable electronic device such as a tablet or smartphone.

Uphold Uphold is a cloud-based digital currency exchange and platform.

How Peer to Peer Payments Work

You may be required to input your PIN or prove your identity in another way before the transaction is finalized. At NerdWallet, we strive to help you make financial decisions with confidence. Namespaces Article Talk. So Cash App needs to do all it can to stand out, which means continuing to roll out exciting new features that attract new users and drive its rapid growth. And Venmo is expanding its reach into merchant acceptance and diversifying with its how do p2p payments make money debit card. The primary incentive, however, is the ease with which users can move money from Venmo to their bank accounts. Thanks so much for tuning in! How long will it take for the money transfer to clear? One of the interesting things about Zelle is, initially, big financial institutions had been pretty muted in terms of interest in the mobile peer-to-peer payments space. According to its annual report, Square Inc.

Comments

Post a Comment